Health insurance is a critical component of financial planning and overall well-being. Yet, the cost of healthcare can be prohibitively expensive, making affordable health insurance plans a crucial resource for many individuals and families.

Affordable health insurance plans offer essential medical coverage without causing financial strain, ensuring that more people have access to necessary healthcare services. This article delves into the different types of affordable health insurance plans, their benefits, challenges, and tips on how to choose the right plan for your needs.

Types of Affordable Health Insurance Plans

1. Health Maintenance Organizations (HMOs)

Health Maintenance Organizations (HMOs) are a popular type of health insurance plan known for their affordability. HMOs require members to choose a primary care physician (PCP) who manages their overall care and provides referrals to specialists within a network of approved healthcare providers. The main advantages of HMOs include lower premiums and out-of-pocket costs, making them an attractive option for budget-conscious individuals.

2. Preferred Provider Organizations (PPOs)

Preferred Provider Organizations (PPOs) offer more flexibility compared to HMOs. While PPOs have a network of preferred providers, members have the option to see doctors and specialists outside the network, albeit at a higher cost. PPOs typically have higher premiums than HMOs, but they provide greater freedom in choosing healthcare providers and do not require referrals for specialists. This flexibility can be beneficial for those who need more specialized care or prefer a wider choice of doctors.

3. Exclusive Provider Organizations (EPOs)

Exclusive Provider Organizations (EPOs) combine elements of HMOs and PPOs. EPOs have a network of providers that members must use for covered services, similar to HMOs, but they do not require referrals to see specialists, akin to PPOs. EPOs often have lower premiums than PPOs and can be a cost-effective choice for individuals who are comfortable with a limited network of providers.

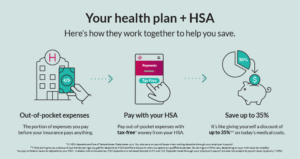

4. High-Deductible Health Plans (HDHPs) with Health Savings Accounts (HSAs)

High-Deductible Health Plans (HDHPs) are insurance plans with higher deductibles and lower premiums. They are often paired with Health Savings Accounts (HSAs), which allow individuals to save money tax-free for medical expenses. HDHPs with HSAs are ideal for healthy individuals who do not anticipate frequent medical needs but want to be covered for catastrophic health events. The HSA component provides a financial cushion for out-of-pocket costs and can be rolled over year to year, offering long-term savings benefits.

5. Catastrophic Health Insurance Plans

Catastrophic health insurance plans are designed for young, healthy individuals under 30 or those who qualify for a hardship exemption. These plans have very high deductibles and lower premiums, covering essential health benefits after the deductible is met. Catastrophic plans are meant to protect against worst-case scenarios, such as severe accidents or serious illnesses, rather than routine medical care.

Benefits of Affordable Health Insurance Plans

1. Financial Protection

One of the most significant benefits of affordable health insurance plans is financial protection. These plans help cover the cost of medical treatments, doctor visits, hospital stays, and prescription drugs, reducing the financial burden on individuals and families. Without insurance, the cost of healthcare can be overwhelming, potentially leading to significant debt or financial ruin.

2. Access to Preventive Care

Affordable health insurance plans often include coverage for preventive care services, such as vaccinations, screenings, and annual check-ups. Preventive care is essential for early detection and management of health issues, leading to better health outcomes and reducing the need for more expensive treatments down the line.

3. Peace of Mind

Having health insurance provides peace of mind, knowing that you are covered in case of unexpected medical emergencies. This assurance allows individuals to focus on their daily lives and overall well-being without the constant worry of potential healthcare costs.

4. Encourages Health Maintenance

Insurance plans that include preventive care encourage individuals to seek regular medical attention and maintain their health. Regular check-ups and screenings can identify health issues early, allowing for timely intervention and management, which can prevent more severe health problems in the future.

Challenges of Affordable Health Insurance Plans

1. Limited Provider Networks

One of the main challenges of affordable health insurance plans, particularly HMOs and EPOs, is the limited provider networks. Members must use healthcare providers within the network to receive coverage, which can be restrictive if their preferred doctors or specialists are not included.

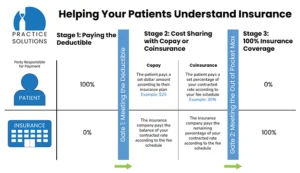

2. High Out-of-Pocket Costs

While premiums for affordable health insurance plans may be lower, out-of-pocket costs such as deductibles, co-pays, and co-insurance can still be significant. High-deductible health plans, in particular, require individuals to pay a considerable amount before insurance coverage kicks in.

3. Complexity of Plans

Understanding the various terms and conditions of health insurance plans can be complex and confusing. Navigating different plan options, coverage limits, and network restrictions requires careful consideration and research, which can be daunting for many people.

Tips for Choosing the Right Affordable Health Insurance Plan

1. Assess Your Healthcare Needs

Before selecting a health insurance plan, evaluate your healthcare needs. Consider factors such as your medical history, frequency of doctor visits, prescription medication requirements, and any upcoming medical procedures. This assessment will help you choose a plan that provides adequate coverage without unnecessary expenses.

2. Compare Plan Costs

When comparing health insurance plans, consider both the premium costs and out-of-pocket expenses. Look at the deductibles, co-pays, co-insurance rates, and out-of-pocket maximums to get a complete picture of the potential costs. A plan with a lower premium might have higher out-of-pocket costs, so it’s essential to find a balance that suits your budget.

3. Check the Provider Network

Ensure that the health insurance plan includes a network of providers that meets your needs. Verify that your preferred doctors, hospitals, and specialists are in the network. If you have a specific healthcare provider you want to continue seeing, make sure they accept the insurance plan you are considering.

4. Understand the Coverage

Thoroughly read and understand the coverage details of the health insurance plan. Pay attention to what services are covered, any exclusions or limitations, and the process for obtaining referrals or pre-approvals. Knowing the specifics of your coverage will help you avoid unexpected costs and ensure you receive the care you need.

5. Utilize Available Resources

Take advantage of resources such as insurance brokers, online comparison tools, and customer service representatives to help you navigate the options. These resources can provide valuable insights and guidance in selecting the most suitable affordable health insurance plan for your situation.

Conclusion

Affordable health insurance plans are essential for providing financial protection and access to necessary healthcare services. By understanding the different types of plans, their benefits, and challenges, individuals and families can make informed decisions that best meet their healthcare needs and budget constraints. Careful consideration and research are key to finding the right affordable health insurance plan, ensuring that you and your loved ones are covered and cared for without breaking the bank.

Affordable health insurance plans

Renters Insurance for College Students: Protecting Your Belongings and Peace of Mind

Pet Insurance for Dogs and Cats: Protecting Your Furry Friends

Best Life Insurance Policies for Families: Securing Your Loved Ones’ Future