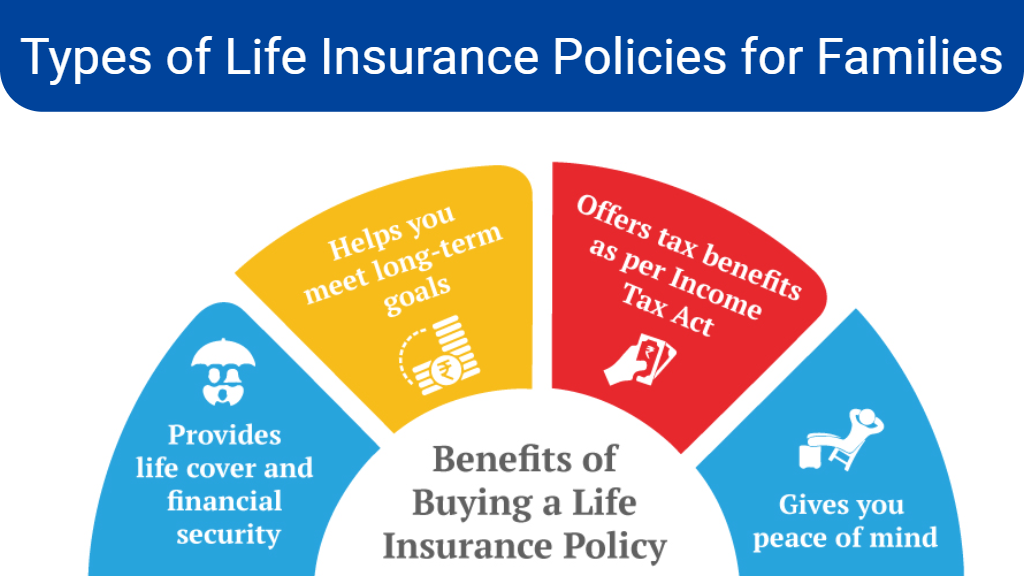

Life insurance is an essential financial tool that provides peace of mind and financial security for your loved ones in the event of your untimely death. For families, having the right life insurance policy is crucial to ensure that dependents are taken care of, debts are paid off, and future financial needs are met.

This article explores the best life insurance policies for families, highlighting their features, benefits, and tips for selecting the right coverage to protect your family’s future.

Types of Life Insurance Policies for Families

1. Term Life Insurance

Term life insurance is a popular choice for families due to its simplicity and affordability. This type of insurance provides coverage for a specific period, such as 10, 20, or 30 years. If the policyholder dies within the term, the beneficiaries receive a death benefit. If the policyholder outlives the term, the coverage ends without any payout.

Benefits:

- Affordability: Term life insurance premiums are generally lower compared to other types of life insurance.

- Flexibility: Policies can be tailored to match the period during which financial protection is most needed, such as until children are grown or the mortgage is paid off.

- High Coverage Amounts: Term policies often offer higher coverage amounts for lower premiums, providing substantial protection for families.

2. Whole Life Insurance

Whole life insurance provides lifelong coverage, as long as premiums are paid. In addition to the death benefit, whole life policies accumulate cash value over time, which can be borrowed against or withdrawn.

Comprehensive Auto Insurance Coverage: Everything You Need to Know

Affordable health insurance plans

Benefits:

- Lifetime Coverage: Whole life insurance ensures that your family is protected no matter when you pass away.

- Cash Value Accumulation: The policy builds cash value, which can serve as a financial resource for emergencies, education expenses, or retirement.

- Fixed Premiums: Premiums remain level throughout the life of the policy, making budgeting easier.

3. Universal Life Insurance

Universal life insurance is a type of permanent life insurance that offers flexibility in premium payments and death benefits. It also includes a cash value component that earns interest.

Benefits:

- Flexible Premiums: Policyholders can adjust their premium payments and death benefit amounts, providing financial flexibility.

- Cash Value Growth: The cash value grows at a variable interest rate, potentially increasing the policy’s value over time.

- Lifelong Protection: Like whole life insurance, universal life insurance provides coverage for the policyholder’s lifetime.

4. Variable Life Insurance

Variable life insurance is another form of permanent life insurance that allows policyholders to invest the cash value in various investment options, such as stocks and bonds. The policy’s cash value and death benefit can fluctuate based on the performance of the investments.

Benefits:

- Investment Opportunities: Policyholders can potentially grow the cash value through investments.

- Death Benefit Protection: Even with market fluctuations, the policy provides a death benefit to beneficiaries.

- Tax Advantages: The cash value grows tax-deferred, and policy loans are typically tax-free.

5. Survivorship Life Insurance

Survivorship life insurance, also known as second-to-die insurance, covers two individuals (typically spouses) under one policy and pays out the death benefit only after both policyholders have passed away.

Benefits:

- Estate Planning: Useful for estate planning purposes, helping beneficiaries pay estate taxes or other expenses.

- Lower Premiums: Generally, premiums are lower compared to two individual life insurance policies.

- Legacy Preservation: Ensures that the death benefit is preserved for heirs or charitable causes.

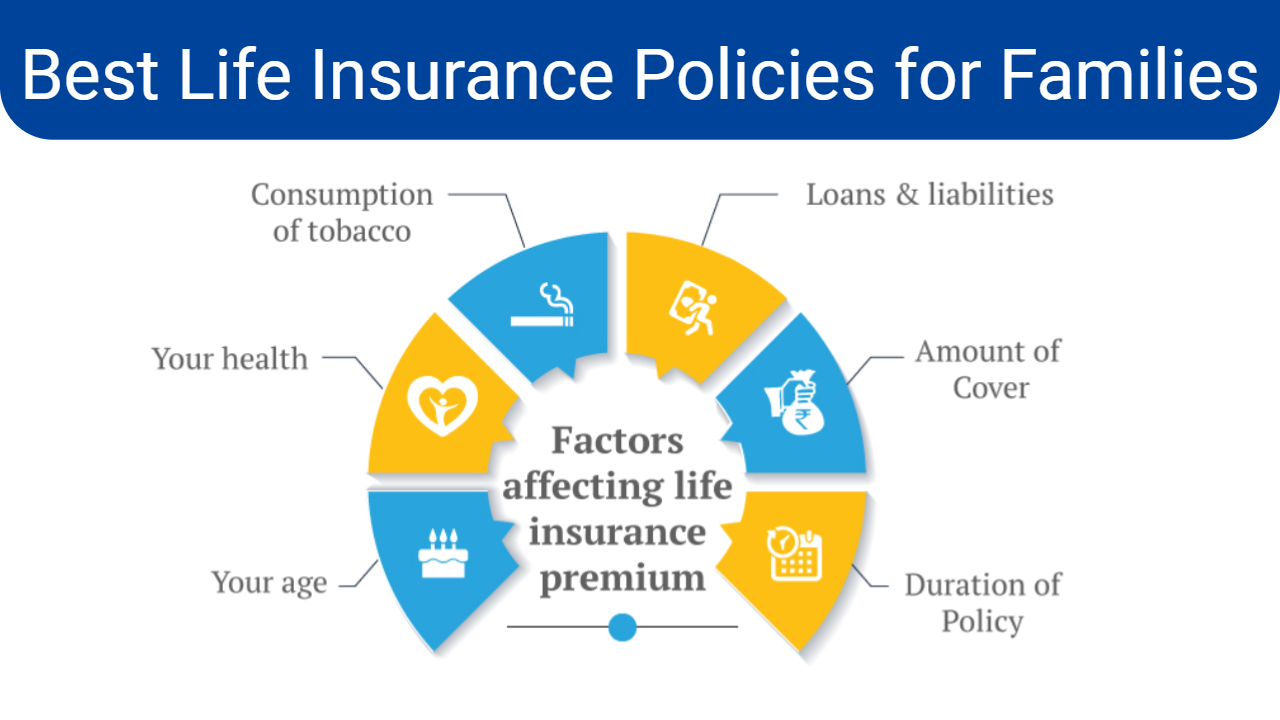

Choosing the Best Life Insurance Policy for Your Family

1. Assess Your Family’s Financial Needs

Evaluate your family’s financial needs, including daily living expenses, outstanding debts, mortgage payments, education costs, and future financial goals. This assessment will help determine the appropriate amount of coverage needed.

2. Consider Your Budget

Review your budget to determine how much you can afford to pay in premiums. Term life insurance is more affordable and suitable for families with tight budgets, while permanent life insurance options like whole or universal life insurance are more costly but offer additional benefits.

3. Compare Different Policies

Compare policies from various insurers to find the best coverage options and rates. Pay attention to factors such as the policy’s term length, coverage amount, premium costs, and any additional benefits or riders available.

4. Evaluate the Insurance Company

Choose a reputable insurance company with strong financial stability and good customer service. Check the company’s ratings from independent rating agencies such as A.M. Best, Moody’s, and Standard & Poor’s.

5. Consider Additional Riders

Riders are additional benefits that can be added to your policy to enhance coverage. Common riders for family life insurance policies include:

- Child Term Rider: Provides term life insurance coverage for your children.

- Waiver of Premium Rider: Waives premium payments if the policyholder becomes disabled.

- Accidental Death Benefit Rider: Provides an additional death benefit if the policyholder dies as a result of an accident.

Comprehensive Auto Insurance Coverage: Everything You Need to Know

Affordable health insurance plans

6. Seek Professional Advice

Consult with a licensed insurance agent or financial advisor to help you understand your options and choose the best policy for your family’s needs. An expert can provide personalized recommendations based on your financial situation and goals.

Conclusion

Securing the right life insurance policy is a critical step in protecting your family’s financial future. By understanding the different types of life insurance policies available and evaluating your family’s unique needs and budget, you can make an informed decision. Whether you choose term life insurance for its affordability or a permanent life insurance policy for its lifelong benefits and cash value accumulation, the right coverage will provide peace of mind and financial security for your loved ones.

Affordable health insurance plans

Renters Insurance for College Students: Protecting Your Belongings and Peace of Mind

Pet Insurance for Dogs and Cats: Protecting Your Furry Friends

Best Life Insurance Policies for Families: Securing Your Loved Ones’ Future